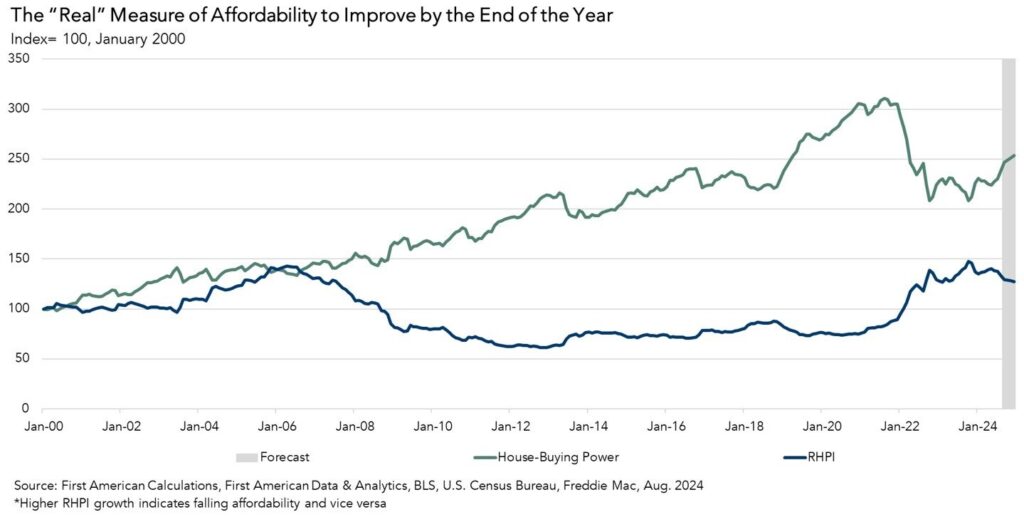

- National affordability improved on an annual basis for the first time since 2021.

- If mortgage rates ease further to 6 percent by the end of the year, income growth trends towards historical average, and nominal house price growth slows but remains positive, affordability will improve by over 7 percent by the end of the year.

- Industry estimates predict that rates will moderate further in 2025, improving the outlook for prospective buyers.

The Federal Reserve Open Market Committee (FOMC) announced a half percentage point reduction to the benchmark federal funds rate in September, the first reduction since they started monetary tightening in early 2022. Furthermore, according to the summary of projections (opens in a new tab/window), the Fed expects to reduce the base rate by an additional half percentage point this year, but even more surprisingly by another full percentage point next year. In other words, the Fed expects to cut the federal funds rate down to 3.4 percent by the end of 2025, which is a much lower rate target than the 4.1 percent target the Fed had projected in June for the end of 2025. What are the implications for the housing market and home buyers?

The labor market is showing clear signs of cooling, and annual hourly wage growth has trended lower (opens in a new tab/window) this year. The Fed’s own projections indicate further slowing in the labor market, which should contribute to a moderating trend of household income growth toward historical norms.

- Real house prices decreased 3.4 percent between July 2024 and August 2024.

- Real house prices decreased 4.4 percent between August 2023 and August 2024.

- Consumer house-buying power, how much one can buy based on changes in income and mortgage rates, increased 4.0 percent between July 2024 and August 2024, and increased 9.3 percent year over year.

- Median household income has increased 3.1 percent since August 2023 and 56.7 percent since January 2014.

- Real house prices are 32.9 percent more expensive than in January 2000.

- Unadjusted house prices are now 62.4 percent above the housing boom peak in 2006, while real, house-buying power-adjusted house prices are 6.9 percent below their 2006 housing boom peak.

- The only states with a year-over-year increase in the RHPI are: Illinois (+0.8 percent) and New Jersey (+0.6 percent).

- The five states with the greatest year-over-year decrease in the RHPI are: Colorado (-12.5 percent), Oregon (-10.7 percent), Hawaii (-8.5 percent), Arizona (-8.3 percent), and Texas (-8.2 percent).

- Among the Core Based Statistical Areas (CBSAs) tracked by First American Data & Analytics, the five markets with the greatest year-over-year increase in the RHPI are: Buffalo, N.Y. (+3.2 percent), Cincinnati (+2.2 percent), Milwaukee (+2.0 percent), Providence, R.I. (+1.6 percent), and Louisville, Ky. (+1.2 percent).

- Among the Core Based Statistical Areas (CBSAs) tracked by First American Data & Analytics, the five markets with the greatest year-over-year decrease in the RHPI are: Tampa, Fla. (-14.0 percent), Denver (-12.4 percent), Portland, Ore. (-11.7 percent), Raleigh, N.C. (-11.6 percent), and San Francisco (-10.1 percent.